Curious about whether insurance covers the cost of foot inserts? Look no further! In this article, we explore whether foot inserts are covered by insurance.

Whether you’re suffering from chronic foot pain or simply seeking extra comfort and support, the answer to this question might save you from emptying your wallet. So, let’s get started and find out if insurance has your back regarding foot inserts.

Overview of Foot Inserts

Definition of Foot Inserts

Foot inserts, or orthotics or shoe inserts, are specialized devices placed inside shoes to provide support, cushioning, and alignment for the feet. They are designed to address various foot conditions and can help improve comfort, stability, and overall foot health.

Types of Foot Inserts

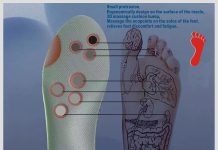

Different types of foot inserts are available, each serving a specific purpose. Orthotics, the most common type, are custom-made inserts designed to align the feet and correct biomechanical issues. Arch support inserts provide extra support and stability to the arches of the feet. Heel cups and cushions are used to provide cushioning and alleviate heel pain. Metatarsal pads help distribute pressure evenly across the forefoot, while toe spacers are used to separate and properly align the toes.

Benefits of Foot Inserts

Foot inserts offer a range of benefits for individuals with foot conditions or those looking for added comfort and support. They can help alleviate foot pain, reduce the risk of injuries, improve balance and stability, correct foot alignment, and enhance overall foot function. By providing proper support and cushioning, foot inserts can significantly improve the quality of life for individuals with foot issues.

Insurance Coverage for Foot Inserts

Understanding Insurance Coverage

Insurance coverage for foot inserts varies depending on the individual’s insurance plan and the specific terms and conditions of coverage. It is essential to understand your insurance policy’s coverage details and requirements to determine if foot inserts are covered and to what extent.

Types of Insurance Plans

Different insurance plans include private health insurance, employer-sponsored plans, Medicare, and Medicaid. Each plan may have different coverage criteria and limitations for foot inserts. It is important to review the specific terms of your insurance plan to understand the coverage available to you.

Coverage Criteria for Foot Inserts

Insurance providers typically have specific criteria that need to be met for coverage of foot inserts. The criteria may include medical necessity, diagnosis of a qualifying foot condition, and proper documentation and prescription requirements. Understanding these criteria is vital to determine if you meet the requirements for coverage.

Qualifying Conditions for Insurance Coverage

Medical Necessity

Most insurance plans require foot inserts to be medically necessary for coverage. This means that using foot inserts must be deemed essential by a healthcare professional to treat or manage a specific foot condition. Medical necessity may be determined based on the severity of the condition, the impact on daily activities, and the effectiveness of other treatment options.

Diagnosed Foot Conditions

To qualify for insurance coverage, foot inserts are often required to address specific diagnosed foot conditions. Examples of commonly covered foot conditions include plantar fasciitis, flat feet, high arches, bunions, and various biomechanical issues. A diagnosis from a qualified healthcare professional is typically required to establish the need for foot inserts.

Documentation and Prescription Requirements

Insurance providers typically require proper documentation and a prescription from a healthcare professional to approve coverage for foot inserts. This may include medical records, diagnostic reports, a detailed description of the foot condition, and a prescription specifying the type and specifications of the foot inserts. Documentation requirements may vary, so it is important to consult with your healthcare provider and insurance company for specific guidelines.

Commonly Covered Foot Inserts

Orthotics

Orthotics are custom-made foot inserts designed to address specific conditions and improve foot function. A podiatrist or orthopedic specialist typically prescribes them, and they are often covered by insurance. Orthotics provide customized support, alignment, and cushioning, helping to alleviate foot pain and improve overall foot health.

Arch Support Inserts

Arch support inserts are designed to provide extra support and stability to the arches of the feet. They can benefit individuals with flat feet, fallen arches, or other conditions requiring additional arch support. Insurance often covers Arch support inserts, mainly when prescribed by a healthcare professional.

Heel Cups and Cushions

Heel cups and cushions are specifically designed to cushion and support the heel area. They commonly alleviate heel pain, such as plantar fasciitis or heel spurs. Depending on the insurance plan and the specific foot condition, heel cups, and cushions may be covered as part of foot insert coverage.

Metatarsal Pads

Metatarsal pads are small inserts placed under the forefoot to provide additional cushioning and support. They often distribute pressure evenly across the forefoot and relieve pain caused by metatarsalgia or Morton’s neuroma. Depending on the insurance plan, metatarsal pads may be covered as part of foot insert coverage.

Toe Spacers

Toe spacers are inserts designed to separate and properly align the toes. They can be helpful for individuals with toe deformities, such as bunions or overlapping toes. While coverage for toe spacers may vary depending on the insurance plan and the specific foot condition, they are sometimes included in foot insert coverage.

Insurance Provider Variances

Differences in Coverage Policies

Insurance providers may have different coverage policies when it comes to foot inserts. Some plans offer comprehensive coverage for various foot inserts, while others may have specific limitations or exclusions. It is essential to review the coverage policy of your insurance provider to determine what foot inserts are covered and any specific requirements.

In-network and Out-of-Network Providers

Insurance coverage for foot inserts may vary depending on whether you use an in-network or out-of-network healthcare provider. In-network providers have negotiated rates with insurance companies and are often more likely to be covered. Out-of-network providers may require additional steps, such as pre-authorization or a higher out-of-pocket cost. Consult your insurance plan or provider directory to find in-network providers for optimal coverage.

Prior Authorization and Pre-Approval

Some insurance plans may require prior authorization or pre-approval for coverage of foot inserts. This means you must obtain approval from the insurance company before obtaining the foot inserts. Following the steps and submitting the required documentation is essential to ensure coverage and minimize the risk of coverage denials.

Obtaining Coverage for Foot Inserts

Consultation with a Podiatrist

To obtain coverage for foot inserts, it is recommended to consult with a podiatrist or healthcare professional specializing in foot conditions. They can evaluate your foot condition, determine the need for foot inserts, and provide the necessary documentation and prescription for insurance coverage. Consulting with a professional ensures that you receive appropriate treatment and increases the chances of insurance coverage.

Patient Responsibility

While insurance coverage can help offset the cost of foot inserts, there may still be out-of-pocket expenses. Understanding your insurance plan’s coverage limits, deductibles, co-pays, and any other costs you may be responsible for. Budgeting for potential expenses will help you afford the necessary foot inserts.

Claims Submission Process

You must typically submit a claim to your insurance provider to obtain insurance coverage for foot inserts. This involves providing the necessary documentation and completing the required forms. It is essential to carefully follow the claims submission process outlined by your insurance company to prevent any delays or denials in coverage.

Alternative Funding Options

Flexible Spending Account (FSA)

A Flexible Spending Account (FSA) is a pre-tax savings account that can be used to pay for eligible medical expenses, including foot inserts. By contributing pre-tax dollars to an FSA, individuals can save on taxes while accessing funds to cover the cost of foot inserts. Reviewing your FSA’s specific rules and limitations is essential to ensure that foot inserts are eligible for reimbursement.

Health Savings Account (HSA)

Like an FSA, a Health Savings Account (HSA) is a tax-advantaged savings account that can be used to pay for eligible medical expenses. Contributions to an HSA are tax-deductible, and funds can be withdrawn tax-free to cover qualifying medical expenses, including foot inserts. Determining if foot inserts are considered eligible expenses under your HSA plan is essential.

Medicare and Medicaid

Medicare and Medicaid are government-funded healthcare programs that cover certain medical expenses. Coverage for foot inserts under these programs may vary, and specific requirements and limitations apply. It is important to consult with your Medicare or Medicaid provider to understand the coverage available for foot inserts and any necessary steps for approval.

Considerations for Coverage Denials

Appealing Coverage Decisions

If your insurance claim for foot inserts is denied, it is possible to appeal the coverage decision. The appeals process allows you to present additional information or evidence to support the medical necessity of foot inserts. It is essential to carefully review your insurance company’s denial letter and follow the steps outlined for the appeals process. Working with a healthcare professional or insurance advocate may increase your chances of a successful appeal.

Medical Necessity Documentation

One common reason for coverage denials is the lack of sufficient medical necessity documentation. To strengthen your coverage case, gather additional medical records, diagnostic reports, or expert opinions highlighting the importance of foot inserts for your specific foot condition. Providing clear and comprehensive documentation can help support your appeal and increase the likelihood of coverage approval.

Working with Insurance Providers

If you encounter difficulties or uncertainties regarding insurance coverage for foot inserts, it is important to communicate and work with your insurance provider. Contact your insurance company directly to address any questions or concerns. They can provide specific information about coverage policies, claim submission requirements, and the appeal process. Building a relationship with your insurance provider can help you navigate the insurance coverage landscape more effectively.

Tips for Maximizing Insurance Coverage

Inquiring About Coverage

When considering foot inserts, it is advisable to inquire about insurance coverage early. Contact your insurance provider and ask about the coverage criteria, specific foot conditions that qualify for coverage, and any documentation or prescription requirements. This information will help you make informed decisions and avoid potential coverage denials.

Choosing the Right Provider

Selecting an in-network healthcare provider is essential for maximizing insurance coverage for foot inserts. In-network providers have contracts with insurance companies and offer services at negotiated rates. Choosing a provider within your insurance plan’s network ensures smoother claims processing and reduces the likelihood of coverage denials.

Proper Documentation

Proper documentation is crucial for obtaining insurance coverage for foot inserts. Keep records of all medical visits, diagnoses, prescriptions, and related documents. By organizing and maintaining thorough documentation, you can provide the necessary evidence to support your claim and increase the likelihood of coverage approval.

Utilizing Network Benefits

Insurance plans may offer additional benefits or incentives for utilizing in-network providers or specific foot insert suppliers. These benefits often include reduced costs or streamlined claims processes. Take advantage of these network benefits to maximize your insurance coverage and minimize out-of-pocket expenses.

Regularly Reviewing Insurance Policies

Insurance coverage can change over time, so it is essential to review your insurance policy regularly. Stayreviewingo coverage policies, the requirements, or network providers. Being informed about your insurance coverage ensures you can take advantage of available benefits and make informed decisions regarding foot inserts.

Conclusion

Foot inserts can be valuable for individuals with foot conditions or those seeking added support and comfort. While insurance coverage for foot inserts varies, understanding your insurance plan’s coverage criteria, qualifying conditions, and documentation requirements is crucial.

By working with healthcare professionals, researching coverage options, and following proper procedures, you can maximize your insurance coverage for foot inserts. Regularly review your insurance policies and consider alternative funding options to ensure you receive the best care for your feet.